Aspiring Enrolled Agents, conquer the US tax code with Jordan Ellis's Enrolled Agent Exam Study Guide. This comprehensive guide provides a stress-free path to EA certification, addressing the challenges of balancing study with daily life. Inside, find in-depth content reviews covering business and individual taxation, IRS representation, and ethics. Full-length mock exams and chapter quizzes build confidence, while time-saving tips optimize your study routine. Master complex tax concepts, bridge theory and practice, and confidently tackle real-world scenarios. Stop feeling overwhelmed and start your journey to a successful career as an Enrolled Agent – ace your exam and unlock exciting new opportunities.

Review Enrolled Agent Exam Study Guide

This Enrolled Agent Exam Study Guide by Jordan Ellis has been an absolute lifesaver! As someone preparing to take the EA exam, I was feeling incredibly overwhelmed by the sheer volume of information I needed to absorb. The prospect of mastering the US tax code felt daunting, to say the least. But this book has completely changed my perspective.

What struck me immediately was the clarity and organization. The guide doesn't bury you under a mountain of jargon; it presents the material in a digestible, step-by-step manner. The layout is incredibly user-friendly, making it easy to navigate and focus on specific areas. The full-length mock exams and chapter quizzes are invaluable for reinforcing concepts and identifying weak points in my understanding. I particularly appreciate the way the author balances the need to prepare for the exam with the practical application of the knowledge afterward. The book doesn't just focus on test-taking strategies; it helps build a solid foundation for a successful career as an Enrolled Agent.

The content itself is incredibly comprehensive, covering everything from business and individual taxation to IRS representation and ethics. While it's packed with information, it never feels overwhelming. The author's writing style is clear, concise, and avoids overly complex language, ensuring that even challenging concepts are easily understood. The inclusion of time-saving tips and study strategies is a fantastic bonus, helping me structure my study sessions effectively and avoid burnout.

I've found the practice questions and mock exams particularly beneficial. They are realistic simulations of the actual exam, allowing me to get comfortable with the format and identify areas where I need additional practice. This has significantly reduced my anxiety about the test and built my confidence. Furthermore, the book's emphasis on applying knowledge to real-world scenarios is brilliant. It bridges the gap between theory and practice, ensuring that I'm not just memorizing facts but truly understanding the underlying principles.

I especially appreciate the author's recognition that passing the exam is only the first step. The guide goes beyond test preparation, offering valuable insights into the practical aspects of working as an Enrolled Agent. This forward-looking perspective is refreshing and extremely helpful. It’s clear that Ellis has a deep understanding of the field and genuinely wants to equip readers with the tools they need to not just pass the exam but thrive in their careers.

In short, this Enrolled Agent Exam Study Guide is a must-have for anyone aiming to become an Enrolled Agent. It's well-structured, comprehensive, and incredibly helpful in navigating the complexities of US tax law. It's provided me with the confidence and knowledge I needed to approach the EA exam with significantly less stress. I wholeheartedly recommend it to anyone embarking on this exciting career path.

Information

- Dimensions: 8.5 x 0.48 x 11 inches

- Language: English

- Print length: 211

- Publication date: 2024

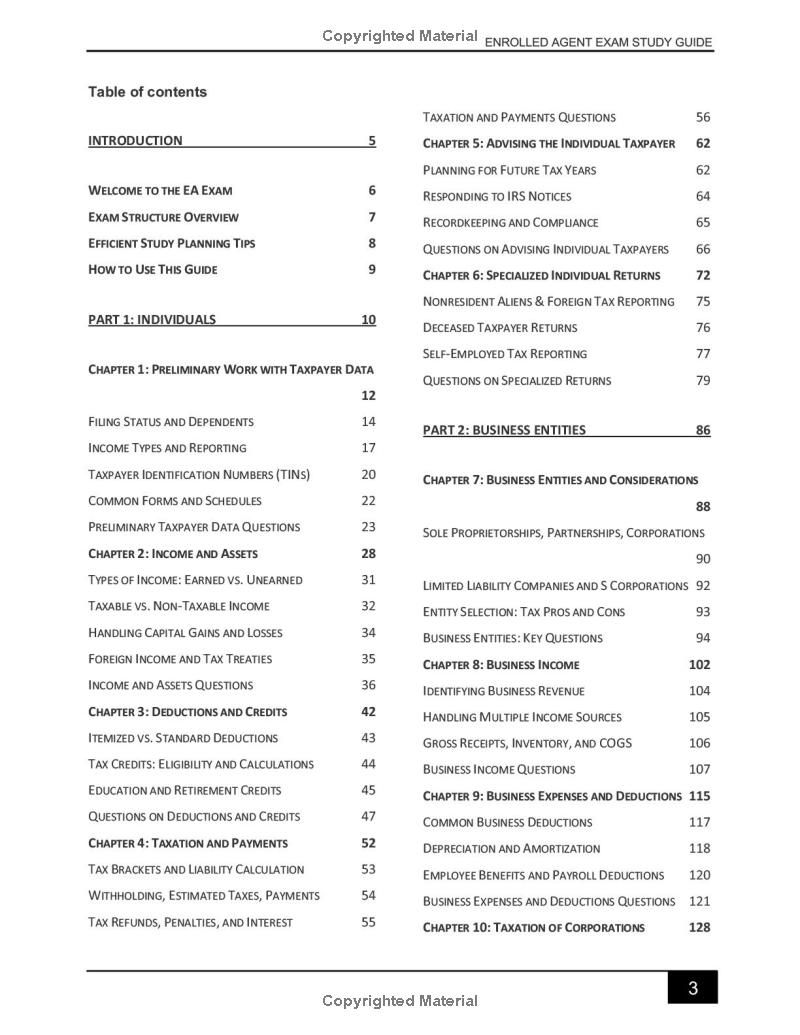

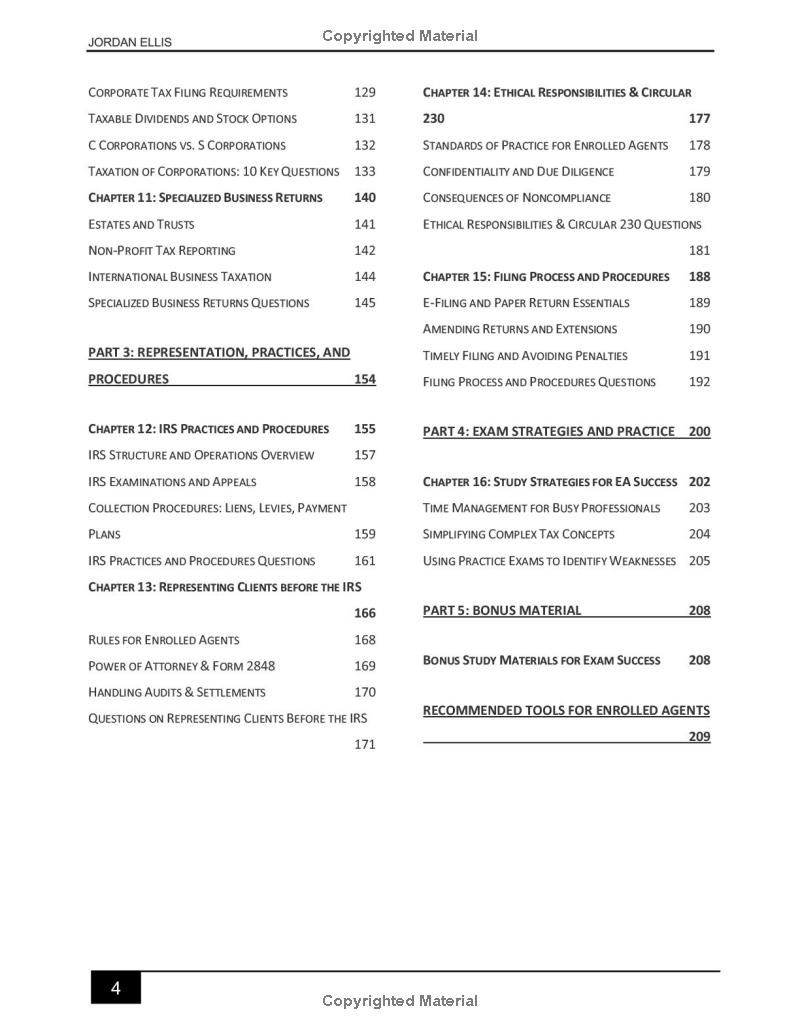

Book table of contents

- CORPORATE TAX FIUNG REQUIREMENTS

- CHAPTER 14:ETHICAL RESPONSIBILITIES & CIRCULAR

- TAXABLE DIVIDENDS AND STOCK OPTIONS

- C CORPORATIONS VS , CORPORATIONS

- STANDARDS OF PRACTICE FOR ENROLLED AGENTS

- TAXATION OF CORPORATIONS: 10 KEY QUESTIONS

- CONFIDENTIALITY AND DUE DILIGENCE

- CHAPTER 11: SPECAUZED BUSINESS RETURNS

- CONSEQUENCES OF NONCOMPLIANCE

- ESTATES AND TRusts

- ETHICAL RESPONSIBILITIES & CIRCULAR 230 QUESTIONS

- NON-PROFIT TAX REPORTING

- INTERNATIONAL BUSINESS TAXATION

- CHAPTER 15: FILNG PROCESS AND PROCEDURES

- SPECIALIZED BUSINESS RETURNS QuESTIONS

Preview Book